LIFE INSURANCE

The lottery is not a retirement plan, and GoFundMe doesn’t equate to a life insurance plan. When we plan for the future, we have an idea or paint a picture of how that looks. If an unexpected event occurs, a proper plan (portfolio) can keep those original plans stay on course. We answer the important questions plaguing your mind and simplify the details, so children can still attend college, the family can remain in place, and even family vacations can still occur. Protection is a key element, but we also discuss living benefits.

What You Need To Know About Life Insurance

Our Most Recent Life Insurance Blog Articles

Navigating Life Insurance

Life is constantly changing, so even if you have a life insurance plan through your employer, if you were to leave that job, you’d also be leaving behind your life insurance. It’s important to have a personal life insurance policy that is there regardless of your employer. We look at everything from a financial perspective and help you choose a plan and build a portfolio that fits your specific needs.

The following types of life insurance provide you with an overview of just how complex the options can be but with our help, we will help you gain a better understanding so you can be confident that you are choosing the right plan for you.

Term Life Insurance

Term Life insurance is life insurance that you pay for during a specified length of time or term – generally one to 30 years. You select the amount of the death benefit or face amount to meet your needs.

Premiums, or payments, which can be the same amount or increase with time, must be made monthly, quarterly, semi-annually, or annually. If you die during the term of coverage, the face amount of your policy will be paid to your beneficiaries. Term insurance policies do not accumulate cash value and therefore usually offer lower premiums than other life insurance products with the same face value.

Universal Life Insurance

Universal Life is permanent insurance that has the potential to accumulate cash value. However, it offers additional features and options. For example, you can increase or decrease your policy's face amount to accommodate your changing protection needs. You can also increase or decrease the dollar amount of your premium payments and make additional lump sum payments to your policy. Since a Universal Life policy accrues cash value, you can borrow against this cash value for any purpose.

You have the option to skip premium payments if your account has accrued sufficient value because the premiums will be taken from the accrued value. A Universal Life policy also has the potential to earn a higher rate of return than a whole life policy, although there is a risk that your rate of return could drop.

Whole Life Insurance

Whole Life Insurance is life insurance that you own for your entire lifetime. The amount of the death benefit or face amount can be selected to meet your needs.

Premiums, or payments, are fixed and can be paid monthly, quarterly, semi-annually, or annually. As more premiums are paid, your policy accumulates a cash value that grows on a tax deferred basis. In essence, whole life is like buying a house versus renting it. The monthly cost is higher than it would be for a term life policy, but with each payment you make you gain equity. You can borrow against a Whole Life policy for any purpose. Loans, however, require you to pay interest and any borrowed amount you do not pay back is deducted from the payout to your beneficiary at the time of your death.

Final Expense Insurance

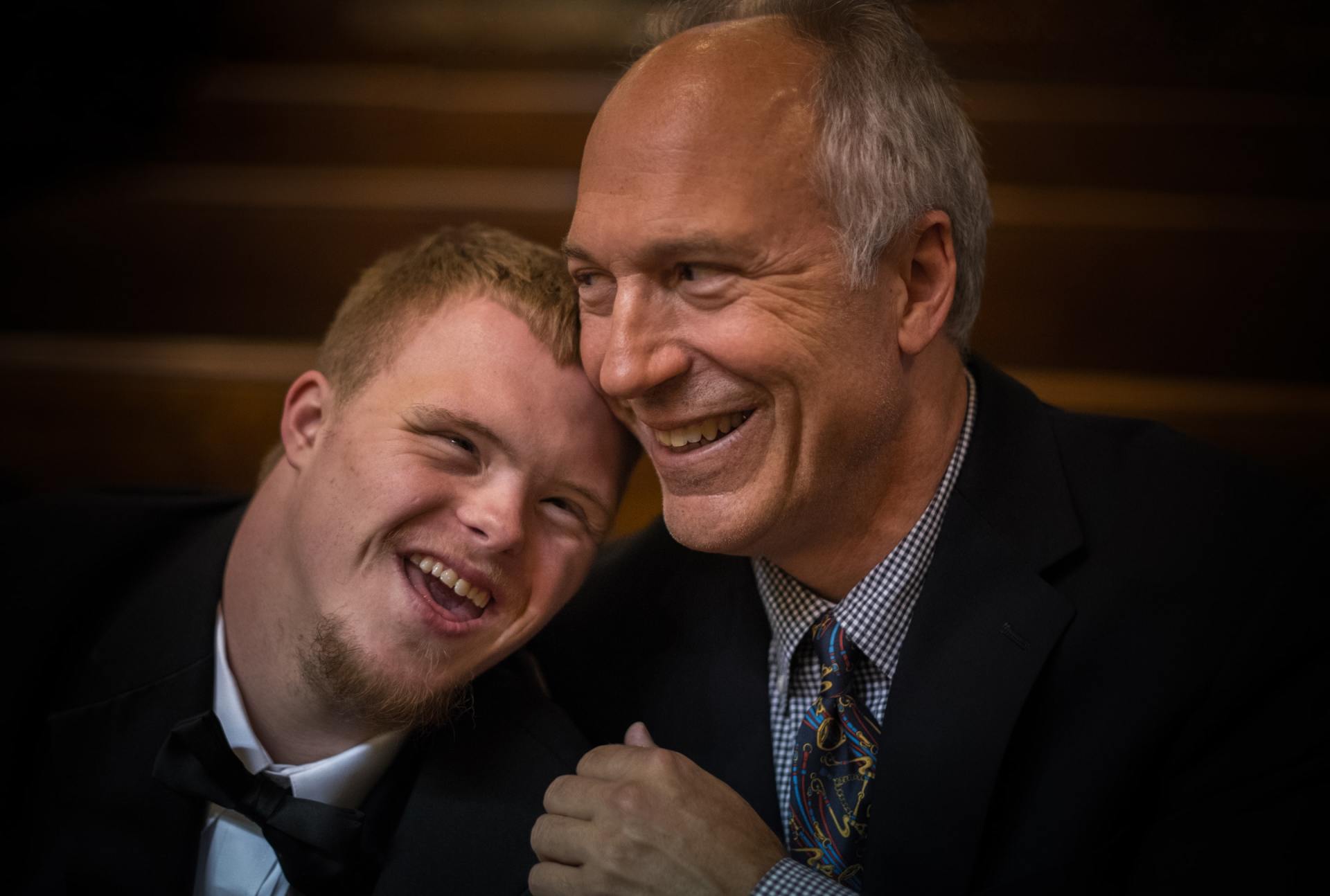

Your family means the world to you. The last thing you want is to leave them with major expenses after you’re gone. Final Expense insurance is life insurance that helps provide the money they may need to pay medical bills, funeral expenses, legal fees or unpaid bills. It is an insurance policy that lets you decide how your assets are distributed. By planning ahead, you can help protect your loved ones from unnecessary financial stress when you die. And, you can distribute your assets in the manner you decide!

Tips To Help You Save Money on Life Insurance

- Only buy what you need

- Get the most appropriate coverage for a mortgage